What Are Synthetic Indices?

Synthetic Indices are computer-generated financial instruments designed to mimic real-world market behavior while remaining unaffected by external factors like economic news, liquidity risks, or geopolitical events. These indices are exclusive to Deriv and operate using a cryptographically secure random number generator, ensuring fair and transparent price movements.

Unlike traditional assets like forex, stocks, or commodities, Synthetic Indices provide predictable volatility levels and are available for trading 24/7, including weekends and public holidays.

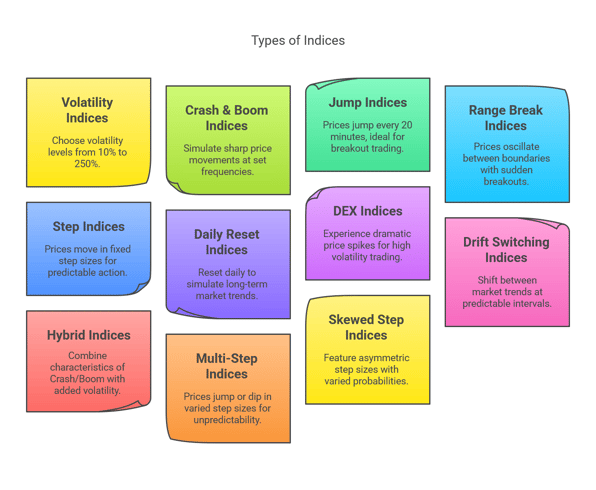

Types of Synthetic Indices on Deriv

✔ Volatility Indices – Choose from 10% to 250% volatility, with tick speeds of every 1-2 seconds for different risk levels.

✔ Crash & Boom Indices – Simulate sharp price surges or crashes at predefined tick frequencies (e.g., Crash 500, Boom 1000).

✔ Jump Indices – Prices jump every 20 minutes (on average), making them perfect for breakout trading.

✔ Range Break Indices – Prices oscillate between upper and lower boundaries, with sudden breakouts.

✔ Step Indices – Prices move in fixed step sizes (e.g., 0.1, 0.2, 0.5), offering predictable price action.

✔ Daily Reset Indices – Reset to a baseline daily, simulating long-term bull or bear market trends.

✔ DEX Indices – Experience dramatic price spikes every 10-25 minutes for high volatility trading.

✔ Drift Switching Indices – Shift between bullish, bearish, or sideways trends at predictable intervals (e.g., 10, 20, or 30 minutes).

✔ Hybrid Indices – Combine Crash/Boom characteristics with a 20% volatility boost for dynamic trading.

✔ Multi-Step Indices – Prices jump or dip in varied step sizes (e.g., 0.1 to 0.5), adding market unpredictability.

✔ Skewed Step Indices – Feature asymmetric step sizes and probabilities, offering 80-90% chance for small moves, 10-20% for sharp moves.

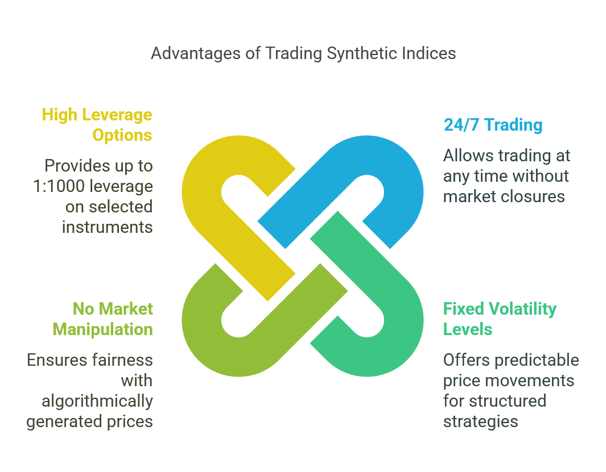

Why Trade Synthetic Indices with Deriv?

🔹 24/7 Trading – No market closures, trade anytime.

🔹 Fixed Volatility Levels – Predictable price movements for structured strategies.

🔹 No Market Manipulation – Prices are algorithmically generated for fairness.

🔹 High Leverage Options – Up to 1:1000 leverage on selected instruments.

🔹 High Profit Potential – Due to their consistent volatility, synthetic indices provide opportunities for both short-term and long-term traders.

Key Benefits of Trading Synthetic Indices on Deriv

1️⃣ 24/7 Trading Availability

2️⃣ Free from Real-World Market Risks

3️⃣ Fixed & Predictable Volatility Levels

4️⃣ No Market Manipulation or Price Gaps

5️⃣ High Leverage & Low Spreads

6️⃣ Diverse Range of Synthetic Indices

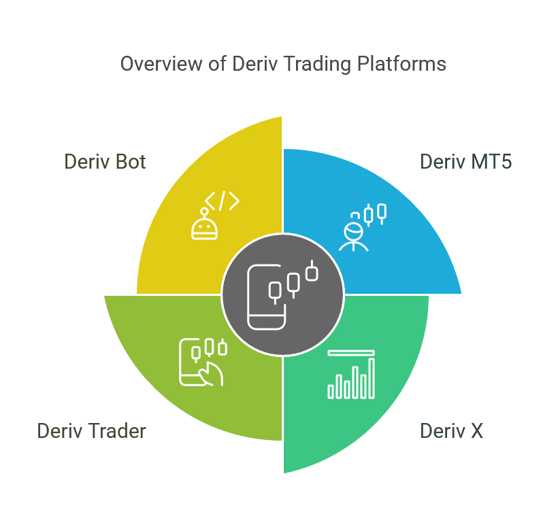

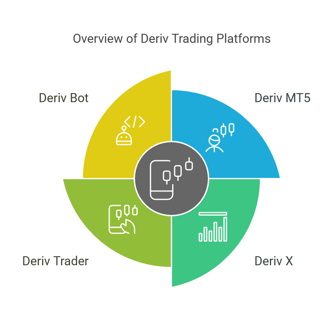

7️⃣ Multiple Trading Platforms & Automation Tools

Online Traders

For anyone. anywhere. anytime. Trade Synthetic indices and options

Global

Support

sam@goldendowfx.com

551-333-1198

© 2025. All rights reserved.

‼️Risk Disclaimer | ⚠️Disclaimer On‼️

Deriv offers complex derivatives, such as options and contracts for difference (“CFDs”). These products may not be suitable for all clients, and trading them puts you at risk. Please make sure that you understand the following risks before trading Deriv products:

a) you may lose some or all of the money you invest in the trade,

b) if your trade involves currency conversion, exchange rates will affect your profit and loss. You should never trade with borrowed money or with money that you cannot afford to lose.